FAFSA: Prepare Now, Get More Aid Later

Things you can do now to maximize your college financial aid

Today, we are helping you prepare for the launch of the FAFSA in October! We detail why you should care about this (free) application and how it can increase the likelihood that you have an affordable college experience.

Total Tips: 6 ✅ (plus bonus resources throughout the post)

Why You Should Care About FAFSA

If you anticipate needing any form of financial assistance during college, it is crucial that you complete FAFSA (Free Application for Federal Student Aid).

FAFSA is not just a form. It is a ticket that can help you reach your athletic and academic goals for college.

Beyond unlocking Federal aid dollars, FAFSA is often a precursor for state aid programs and helps determine your need-based aid at D3 schools you’re accepted to.

While the application is typically released on October 1st of every year, although in recent years there have been various delays. Regardless of when the form comes out, there are still a number of thing you can do right now to prepare.

Today, we’re covering a checklist of six tips to get prospective college athletics recruits started!

Preparing for FAFSA

The DOE’s rollout of the new and improved “Better FAFSA” was not great.

To prevent similar issues in future years, the U.S. Department of Education conducted a round of beta testing and we’re happy to say the results look promising.

When recruits opened up the 2025-26 form they saw a streamlined and more accessible version than past years, with simplified income verification and 50% fewer questions.

The 2024-25 form took less time on average to fill out (with most students and families completing it in <15 minutes) and the 2025-2026 form was reportedly able to be completed in ~10 minutes.

Additionally, we should expect to see more students eligible for aid. Last year, the Department of Education estimated that ~1.7 million more students received the maximum Pell Grant.1 We hope to see similar numbers reported after this FAFSA window closes next June.

To begin your FAFSA process and prepare for the application’s launch on October 1st, here’s what you need to do:

1. Create an FSA ID

What it is: An FSA ID is a username and password that allows students and parents to access the FAFSA, sign it electronically, and track applications.

When to create it: ASAP - but at least a few days before filling out the FAFSA to avoid processing delays. If this is your first time completing FAFSA, it could take 1-3 days for your FSA ID to be verified. Please don’t wait and have this delay your process.

Who needs one: Both the student and one parent (if the student is a dependent) should create their own FSA IDs.

PRO TIP: Write down your FSA ID and keep it somewhere secure so you have it for next year!

2. Gather Required Documents

Social Security Number (SSN): Students and parents need their SSNs, or an Alien Registration Number if they’re not U.S. citizens.

Tax Returns: Collect federal income tax returns from the prior year (e.g., for the 2026-2027 school year, use 2024 tax information).

W-2 Forms: Required for any income earned by both students and parents, as well as information on any untaxed income.

Bank Statements and Financial Records: Including information on savings, investments, and any other assets.

Records of Any Non-Taxable Income: Examples include child support or veteran’s benefits.

3. Know FAFSA Deadlines

Federal deadline: Generally, the FAFSA opens on October 1st for the next school year and the federal deadline is June 30 of the same school year.

State and School Deadlines: Many states and colleges have their own, often much earlier, deadlines for financial aid. Check the FAFSA website or ask the school’s financial aid office to confirm these dates.

Confused about D3 financial aid?

Check out our 5-part series on financial aid resources in every U.S. State with a D3 school. Note that many of the state-specific options discussed require FAFSA as a starting point for eligibility:

4. Discuss College Choices and Application Plans

Why it matters: Students list colleges on the FAFSA to send financial information directly to them, which helps determine aid packages.

How to do it: Make a list of colleges before starting FAFSA, including schools the student is considering seriously and applying to.

PRO TIP: 5 min. video tutorial for creating your college list

5. Understand Dependency Status

Why it matters: The FAFSA asks questions to determine if a student is dependent or independent, which affects whose financial information is required.

Common criteria: Students under 24, unmarried, and without dependents of their own are usually considered dependents and need to include their parents' financial information.

6. Consider FAFSA Help Resources

School counselors: High schools often offer FAFSA workshops or guidance on filling out forms.

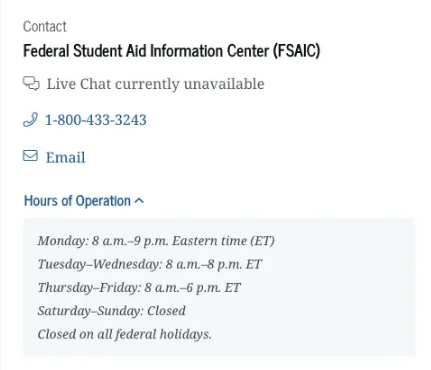

Online resources: FAFSA has an official help center and phone line for questions. Local financial aid offices can also assist. See picture below for the contact phone number and hours of availability.

By preparing in advance, students can focus on accurately filling out the FAFSA, reducing the risk of delays or mistakes.

We hope you learned something about FAFSA today.

For more D3 recruiting and admissions advice check us out on Twitter (X), Instagram and Youtube.

Until next time ✌️

-D3Direct